How-to: Add Sales Tax to Campaign Purchases

Automatically add sales tax to item purchases to comply with local laws and regulations.

Some states require that sales tax be added to any purchases made through your fundraisers. If you’re selling taxable items, you may need to report these purchases to the state and pay taxes. Be sure to check your state's rules and regulations before you start fundraising.

Sales tax can be applied to the following items:

- Auction items

- Store (Sale) items

- Crowdfunding Perks

- Event Tickets

- A-Thon or Peer-to-Peer registration fees

Taxes only apply to purchased items. If a donor purchases an item and gives a donation at the same time, the sales tax will not be applied to the donation.

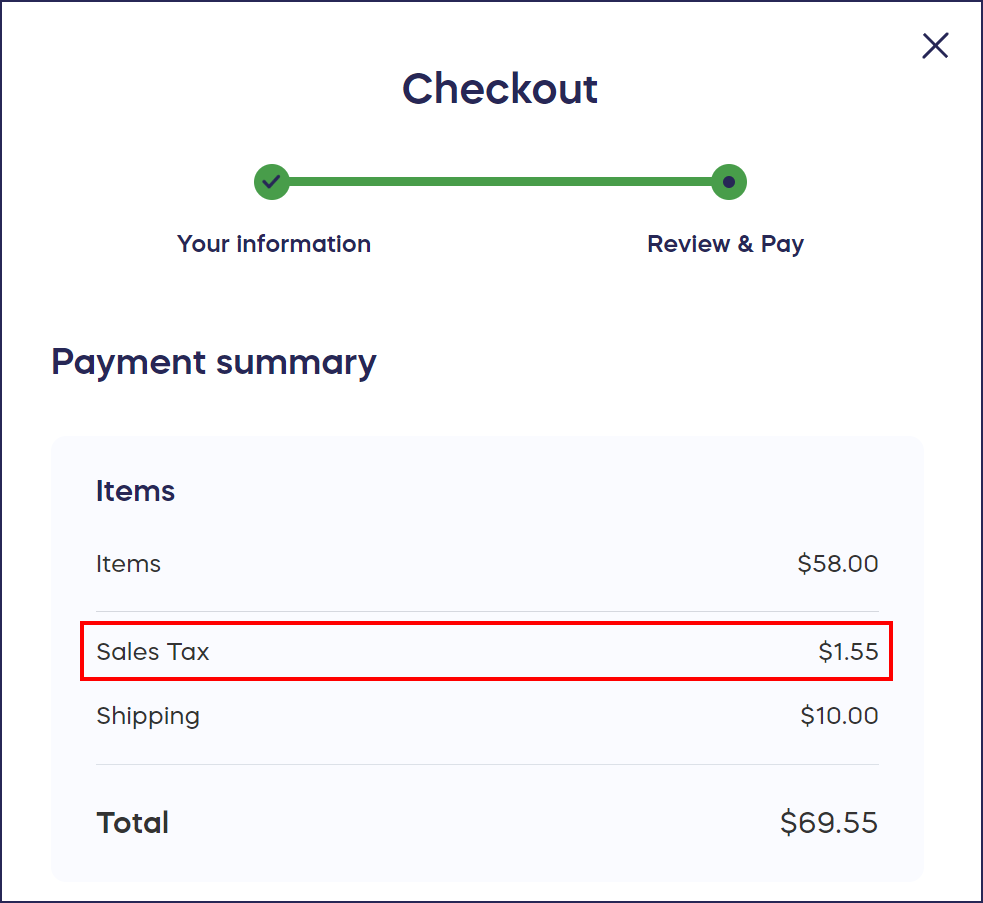

When enabled, sales tax will be automatically added at checkout:

Auction Items

- Go to Campaigns in the left menu.

- If you’ve chosen a list view, click on the Campaign title. If you've chosen a grid view, click on the Campaign image.

- Select Campaign Setup*.

- Go to Auction in the timeline at the top.

- Scroll down to Expand optional settings and click on the down arrowhead (⌄).

- Scroll down to Do you want to collect sales tax for items?, check the box, and enter the sales tax amount:

- Select Save.

All Other Items

- Go to Campaigns in the left menu.

- If you’ve chosen a list view, click on the Campaign title. If you've chosen a grid view, click on the Campaign image.

- Select Campaign Setup*.

- Go to Options in the timeline at the top and select the relevant Activity section (e.g., if you're updating an Event Ticket, select Ticketing Options).

- Scroll down to Do you want to collect sales tax for items?, check the box, and enter the sales tax amount:

- Select Save.

Good to Know

- If you're running a Campaign as an Advocate or Corporate Social Responsibility program, you won't be able to add sales tax.

- If you add sales tax, you can use the View Donations report to track how much you've accumulated: View and Export a List of Donations and Donor Information.

*Terminology may differ according to Campaign settings.

Have more questions? Submit a ticket